Why Choose Koste?

- Qualified Professionals

Our team comprises both Chartered Quantity Surveyors and Tax Experts, ensuring a dual-layer of expertise. - Maximised Deductions

We harness current tax legislation to ensure you get the maximum depreciation deductions. - ATO Compliance

With the ATO’s increased focus on landlord expenses, our reports are meticulously crafted to remain compliant, giving you peace of mind.

Tailored Pricing for Your Unique Needs

- Transparency

Know your starting costs with prices from just $395+GST. - Customisation

Only pay for what you need. If a site survey is required, additional fees apply. - Value-Driven

We review your property free of charge, determining the cash benefits before any commitments.

Our Process

Free Property Review

Understand the potential cash benefits.

Tailored Quote

Receive a customised quote based on your property’s specifics.

Detailed Reporting

Benefit from our comprehensive tax depreciation report.

Ongoing Support

We’re here for any questions or further assistance.

Potential Savings

Calculator

Estimate your potential tax savings with our interactive calculator.

Our Residential

Depreciation Packages

We offer three options for residential tax depreciation based on your budget.

First, pick the one that fits your needs and then make a secure payment to confirm your order. Once payment is confirmed, we’ll start working on your report. Our team at Koste Quantity Surveyors takes care of each client’s report and delivers it back to you promptly, no matter your budget.

What is included in our packages?

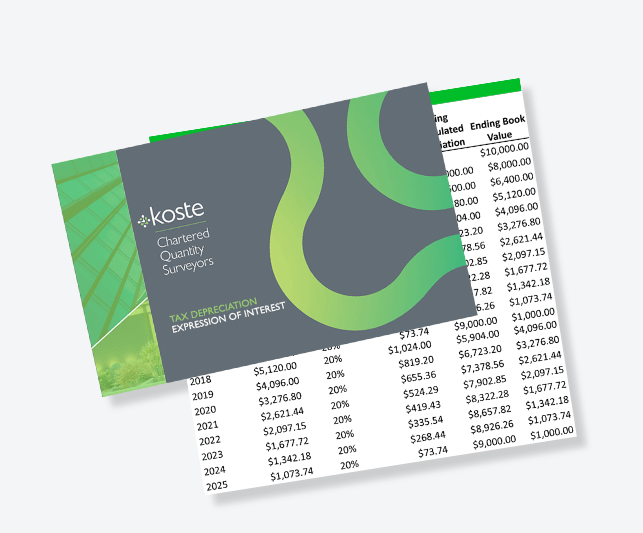

– 40-year depreciation schedule

– Diminishing & Prime Cost methods

– Low Value Pooling & Writeoffs

– Common Areas – Previous Owner & Renovation Works

– Fast Report Turnaround

– Qualified Quantity Surveyor Review / Approval

– Split Ownership Report

Silver

$395+GST

Desktop Inspection & QS Review

One-off payment

Gold

$495+GST

Virtual – QS Inspection & QS Review

One-off payment

Platinum

$695+GST

Physical – QS Inspection & Review

One-off payment

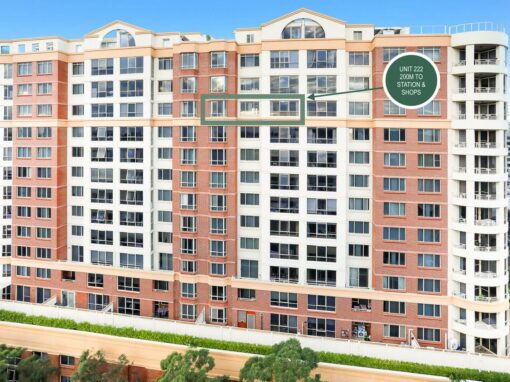

Get a

Sample Report

Fill in the form below to get a sample report for your investment property

Get Your Custom

Tax Depreciation Schedule Today

Reach out to our experts today and ensure you’re maximising your property investment returns.

Get a sample report

"*" indicates required fields