Koste is a leader in Tax Depreciation because that is all we do.

We master every detail of property tax depreciation, staying update with annually changing legislation. Many successful businesses trust Koste as their Asset & Tax Depreciation provider to maximise their returns.

COMPLETE YOUR TAX DEPRECIATION ASSESSMENT

Find out more about our Residential Tax Depreciation Packages

Our all-inclusive Residential Depreciation Tax Package simplifies the process with one straightforward price. Speak to a team member for further information.

Transparency

Know your starting costs with prices from just $695+GST

Customisation

Only pay for what you need. If a site survey is required additional fees apply

Value-Driven

We review your property free of charge, determining the cash benefits before any commitments

Your trusted partner in Tax Depreciation

As the CEO of Koste, Mark Kilroy, I can bodly declare that we are your trusted partner in tax depreciation, dedicated to helping you maximise your income tax savings.

As Australia’s only Chartered Quantity Surveyor firm specialising in tax depreciation, and with full AIQS membership, our ATO-compliant reports guarantee maximum deductions for all qualified assets.

Through our innovative AI-driven software, we deliver unmatched efficiency, accuracy, and insights, setting new industry standards and ensuring clients receive a competitive edge.

Our Process

Designed to maximise your savings with clarity and ease—step by step

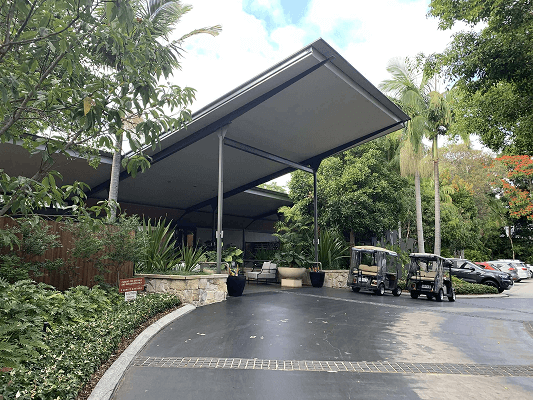

Proud of every project outcome

At Koste, we take pride in the outcome of every project, bringing unmatched expertise to tax depreciation.

Trusted by professionals across industries, we focus solely on property tax depreciation, allowing us to master every detail and stay up-to-date with changing legislation.

Many successful businesses rely on Koste as their asset and tax depreciation partner to maximise returns, and we are committed to delivering exceptional results on each and every project.

Trusted by leading businesses

Learn more at

The Knowledge Hub

Dive deep into the world of tax depreciation and advisory services. Our Knowledge Hub is designed to equip both investors and partners with the information and tools they need to succeed.

Read

Watch

Learn

Industry Memberships and Awards